-

https://t.co/CqJ6a4Tx6i The first article I’ve ever seen on dark store theory that is actually fair to property owners. #cre #taxpolicy

-

You really should try to avoid going into court with fundamentally flawed appraisal reports. #cre #darkbox https://t.co/UKv3eWcf5e

-

https://t.co/gPaQp07zsH At this time Walgreens is not releasing a list of the 200 locations to be closed.

-

-

-

The retail apocalypse marches on #cre https://t.co/mcfr1eZd0p

-

-

-

https://t.co/qObl8FrYAI Can you hear the investors flocking to real estate? #cre

A New Tax on Illinois Commercial Real Estate Would Affect Values

How would commercial real estate values in Illinois be impacted if a new property tax is levied to address the state’s multi-billion dollar deficits?

Read moreCould a Property Tax Increase on Commercial Real Estate be Coming to Illinois?

CHICAGO, IL

Last month a panel of economists at the Chicago Federal Reserve Bank suggested that the fairest method of paying the unfunded liabilities that have been accumulated by Illinois would be to impose a statewide 1% property tax on residential properties. This proposed 1% tax would be on the full fair market value of a home rather than on a fraction of the fair market value, and would result in a median increase of 43% in property taxes. It has been estimated that the new tax would need to continue for 30-years to pay off the state's $216,100,000,000 debt. Based on a 30-year mortgage at a 4% interest rate, this tax would give a homeowner a liability equivalent to 17.46% of a home's value. An immediate decline in home values would be expected.

The spokesman for the Illinois Realtors Association, Jon Broadbooks, said that if homeowner's taxes were to increase that much, "I think, you know, people would just be screaming." This brings to question whether Illinoisans would tolerate the state's unfunded liabilities being shouldered entirely by homeowners. The Statehouse is also in revolt over the proposal by the Fed economists. House Resolution 1072, in response to the Fed proposal, called on representatives to oppose any new statewide property taxes.

In fact, it appears that the Federal Reserve Bank economists anticipated the blowback from homeowner's and legislators. In the closing line of the report the economists stated, "In future work, we will explore additional options for spreading the pain, including expanding the base to cover rental and commercial properties, and options for making the tax progressive." It would therefore appear that the proposal from the Fed may have been a trial balloon designed to create outrage at the initial solution, so as to make their future suggested solutions more palatable to the voters and legislators.

If the Fed economists were to release a new proposal that only called for a 0.25% increase on homeowners and a 0.50% increase on commercial, industrial, and rental properties then the majority of Illinoisans could find this solution to be much more desirable than the previous 1% solution that only applied to them. They may then find themselves supporting a proposal that ask less of them, and shifts the tax burden to someone else. Their support would not have been possible without the collective outrage garnered from the initial proposal. In a future post I will examine the possible impact that a new statewide property tax could have on commercial properties.

For DoubleTail Valuations

Jason King, MAI

A Rising Treasury Yield Rate Could Lower Commercial Real Estate Values

CHICAGO, IL (May 21, 2018)

Goldman Sachs published an article today (Goldman: Don't worry about rates until the 10-year yield nears 4%) about the potential negative impact of rising interest rates on stock valuation. Since investors consider the 10-year treasury a safe-haven investment, the 10-year yield rate is viewed as the baseline for all other investments. The expected yield rates for other investments will be higher than the 10-year yield rate in proportion to the additional risk that the market perceives in these investments. This applies to all types of investments including stocks and commercial real estate.

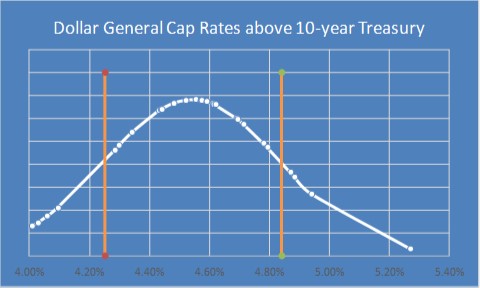

For example, an analysis of twenty-eight new Dollar General investment sales that occurred between March 2014 and March 2018 indicated that they sold at capitalization rates ranging from 6.50% to 7.20% with a mean of 6.79%; a median of 6.80%; and a mode of 6.50%. These capitalization rates are sensitive to changes in the 10-year yield rate, as can be seen in the following graph:

While there is not a perfect correlation between the 10-year yield rates and the Dollar General capitalization rates, there is clearly a noticeable relationship between the two. The following distribution curve shows that one standard deviation of these sales is found in a range between 4.25% and 4.84% above the 10-year treasury rate.

68% of New Dollar General Investment Sales will be between 4.25% and 4.84% above the 10-year Yield Rate

Dollar General sales have been flirting with 7.00% capitalization rates since mid-2017. With a 10-year yield rate currently at 3.07%, capitalization rates for new Dollar General stores can be expected to consistently climb above 7.00% with some sales in the 7.25% to 7.50% range. The impact of just a 15-basis point increase in capitalization rates would be to lower the value of current properties by approximately 2.14%. For future Dollar General stores a 15-basis point increase in capitalization rates would put upward pressure of approximately 2.23% on store rents.

While Goldman Sachs assures us that we do not need to worry about stock prices dipping until the 10-year rate is at 4.00%, Commercial Real Estate can expect to see negative impacts at 3.00%. Dollar General stores are just one example of the impact that increasing interest rates will have in the overall Commercial Real Estate market. As interest rates increase, we can expect capitalization rates to increase, rents to increase, and existing stock with signed leases to take a hit in value.

For DoubleTail Valuations

Jason King, MAI